What Is a Virtual Account (VA) and How Does It Work?

VAs are becoming a must for companies in today's industry that want flexible and effective foreign transactions. Professional services, import/export, and e-commerce are among the industries that mostly depend on VA to optimize their financial processes. MoneyCollect's reputation as a dependable supplier of VA solutions stems from our proficiency in international payments. With more than ten years of experience in international payments, MoneyCollect is pleased to present Virtual Account (VA) —— MC Wallet, our newest offering. Please read on for more information on how to open a VA account with MC Wallet quickly and simply.

What Is MoneyCollect's Virtual Account?

A virtual account is a digital payment method in which every consumer has their own virtual account generated for them. Payments are made by customers using their unique Virtual Accounts. To ensure that no two Virtual Account numbers are the same, each one has a distinct client ID. This makes it possible for transactions involving several clients to be automatically identified. Sending a transfer receipt is not required after the transaction is finished.

How MoneyCollect's Virtual Account Work

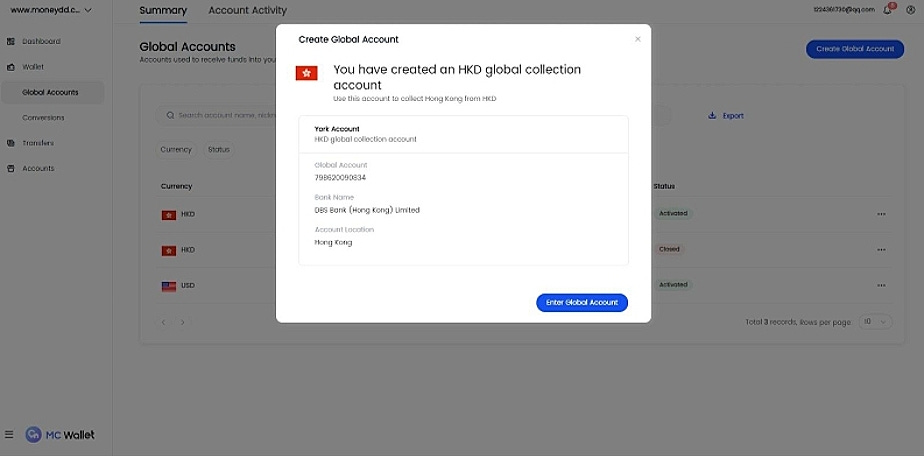

To enjoy the advantages of a Hong Kong account, take advantage of MoneyCollect's MC Wallet's unmatched convenience. Our commitment is to deliver a smooth and effective banking experience, acknowledging the intricacies involved in doing business globally. To get started using MC Wallet, just follow these easy steps:

Step 1. Switch to MC Wallet via moneycollect.com Click "Sign up."

Step 2. Enter your email address and the verification code.Check the box to agree. Click "Sign up."

Step 3. Click "Sign in" to enter your email address and password. Click "Sign in."

Therefore, you may easily create a Hong Kong account online with MoneyCollect in just three easy steps.

Benefits of Using MoneyCollect's Virtual Account

1. Convenient Overseas Account Setup

When it comes to opening accounts abroad, MoneyCollect's Virtual Account offers merchants an easy and rapid alternative. There is no need for laborious paperwork; you can apply online and quickly create an account.

2. Cost-Effective

Generally speaking, virtual bank accounts are less expensive than traditional ones. Merchants can save expenses and enhance cash use using MoneyCollect's Virtual Account, which eliminates account establishment and maintenance fees.

3. Secure and Reliable

MoneyCollect uses cutting-edge security technologies and years of experience processing cross-border payments to guarantee the security of funds and the privacy of transactions. With confidence, merchants can conduct international transactions using the virtual account.

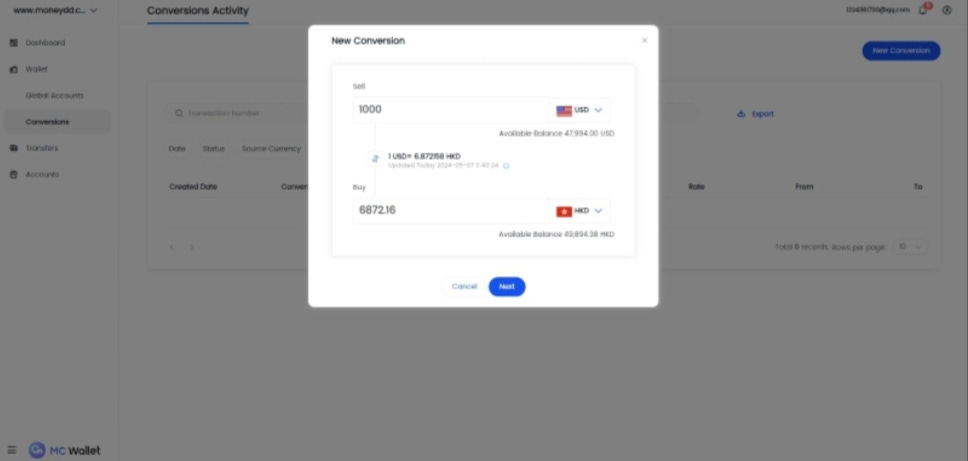

4. Efficient Fund Management

Merchants can examine account balances and transaction records in real-time, handle multi-currency money with ease, and increase fund management efficiency and transparency by using the virtual account.

5. Multiple Payment Methods

To accommodate the wide range of payment requirements of businesses and their clients, MoneyCollect's Virtual Account accepts credit cards, bank transfers, and e-wallets, among other payment options.

6. Enhanced International Business Convenience

With the virtual account, businesses may conduct international transactions more easily, taking payments from clients anywhere in the world and growing their market without hindrances.

7. Flexible Customization Services

MoneyCollect provides adaptable account services that may be tailored to each merchant's unique requirements, guaranteeing that they receive the best possible outcome.

8. Professional Customer Support

MoneyCollect's knowledgeable customer care team is available 24/7 to assist merchants with inquiries and issues. Using MoneyCollect's Virtual Account, merchants can enjoy convenient foreign payment services, lower expenses, and effective fund management, aiding business growth.

MoneyCollect's Virtual Account to Support Your Business

MoneyCollect's Virtual Account not only enhances customer convenience but also offers significant benefits for businesses, including:

Simplified Accounting Documentation

Because every transaction is automatically documented, transfer receipts don't need to be manually checked. This saves important time and enables quick follow-up on orders.

Adaptable Transaction Management

The Virtual Account improves the efficiency of transactions and is appropriate for all types of businesses. It is an essential payment method because it works flawlessly with a variety of platforms, such as apps, websites, and marketplaces.

24/7 Access to Payments

With virtual accounts, users may be flexible and pay whenever they choose, day or night. The convenience and enjoyment of customers are increased by this 24/7 availability.

Effective Payment Processing

Easily manage quantities and delivery because every customer has a unique ID. This facilitates the effective sorting of balances and transaction data. Easy transaction monitoring is made possible by real-time information capture through a single API.

Improved Protection of Customers

The Virtual Account number can be made to expire after a transaction is finished, protecting customers and preventing unlawful use.

Through the quick, adaptable, and secure payment solutions offered by MoneyCollect's Virtual Account, businesses may greatly enhance their operational workflows and customer experiences.

Our offerings include MC Payment: Your Global Online Payment API in addition to MC Wallet. This program offers businesses all over the world easy and safe online payment options.

MC Payment: Your Global Online Payment API

Our online payment API solution ensures a smooth and efficient transaction process by making it simpler to accept payments from various sources. Use these actions to benefit from our acquisition services:

Step 1. Register Your Business First, register on our platform, then submit the necessary company documents for approval.

Step 2. Integration: Assist in integrating our payment gateway with your present systems by using our comprehensive API documentation.

Step 3. Configure Payment Options: Adjust and configure the payment options—such as support for several currencies and a variety of payment methods—to your business's needs.

Step 4. Start Getting Paid: After everything is in place, you may start getting paid by customers.

Conclusion

We at MoneyCollect provide a variety of cutting-edge payment options to help your company:

Convenience: Makes payment procedures easier for clients and companies alike.

Efficiency: Time and resources are saved through simplified platform integration.

Security: Cutting-edge safeguards for money and information.

Support: Committed customer care is offered twenty-four hours a day.

MoneyCollect is a dependable Virtual Account service that works well for businesses. Experience the advantages of simplified, real-time transactions by integrating MoneyCollect right now!